Navigating the Complexity of Growing Businesses: How Zoho Payroll USA Transforms Operations

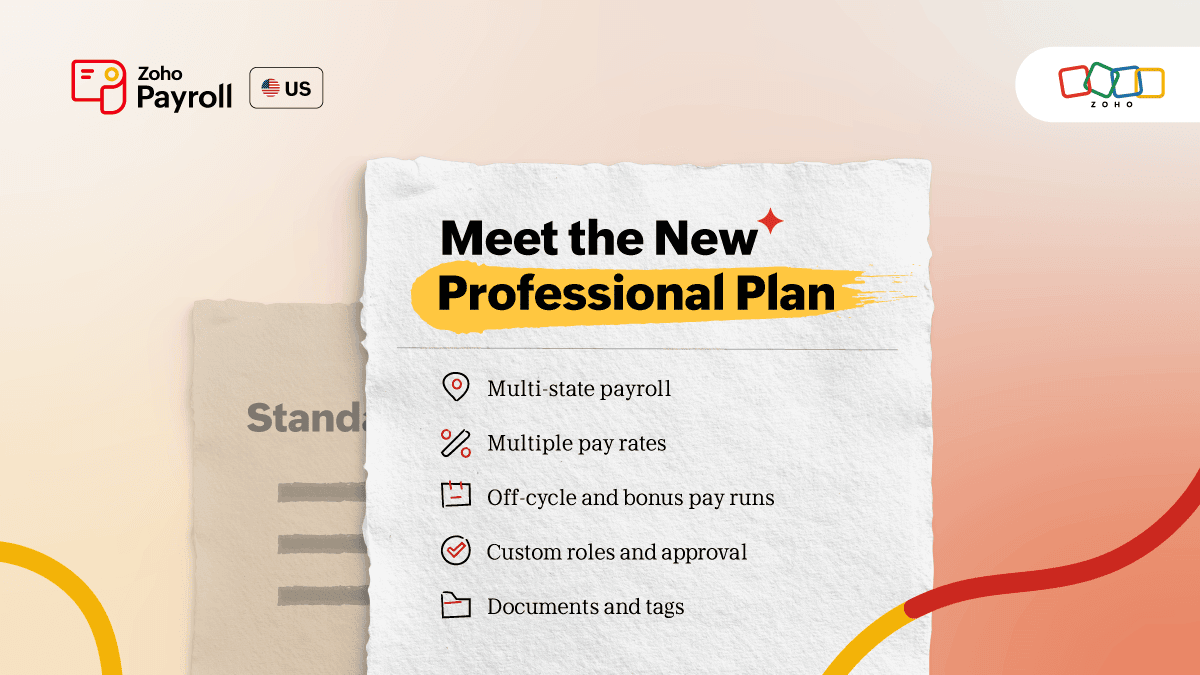

Multi-state payroll compliance represents a significant challenge for businesses operating across state lines. Each state has its own tax laws and employment regulations, making it daunting to maintain compliance. Fortunately, Zoho Payroll introduces a robust multi-state payroll feature that simplifies this process, allowing businesses to onboard employees from various states and manage their payroll in a single run. This not only streamlines operations but ensures automatic compliance with state tax laws, allowing organizations to focus more on strategic growth initiatives.

Flexibility in Compensation: Multiple Pay Rates

With diverse compensation structures like overtime pay, shift allowances, and project-based pay, flexibility is key. Zoho Payroll’s addition of multiple hourly pay rates empowers employers to assign different rates based on specific work requirements. This flexibility guarantees accurate compensation for every hour worked, fostering a compliant and fair payroll environment.

Off-Cycle and Bonus Pay Runs: Timely Rewards

In a high-paced business ecosystem, some payments can't wait for the next regular pay cycle. Zoho Payroll offers off-cycle and bonus pay runs, which allow businesses to disburse commissions, bonuses, and corrections quickly and securely. This feature ensures employees receive timely rewards for their contributions, bolstering morale and enhancing overall productivity.

Streamlined Approval Flows and Custom Roles

Payroll errors can be costly, but with the right tools, they are often preventable. Zoho Payroll introduces approval workflows for payroll, enabling businesses to implement an extra verification layer for every pay run. This ensures that the necessary personnel—whether they're the HR manager, finance lead, or external accountant—can double-check payroll before processing. Moreover, custom user roles grant precise control over access to information, ensuring that team members can view only what’s necessary based on their specific responsibilities.

Organizational Efficiency: Documents and Reporting Tags

Effective document management is essential for maintaining comprehensive employee records. Zoho Payroll's Documents module streamlines this process, enabling businesses to upload, store, and share important files in one centralized platform. Reporting tags enhance efficiency further by allowing companies to label and filter reports based on specific criteria, such as shifts or roles. By incorporating this feature alongside custom employee fields, businesses can capture additional details like certifications or demographic data for diversity reporting.

Business Transformation through Scalable Payroll Solutions

The Professional plan from Zoho Payroll USA is designed with the needs of growing teams in mind, equipping them with advanced features to tackle complex payroll operations. This plan goes beyond mere payroll management; it transforms business operations by providing necessary flexibility, customization, and compliance.

- Efficiency and Compliance: Automating intricate payroll tasks allows businesses to reduce administrative burdens and focus on strategic growth.

- Employee Satisfaction: Accurate and timely compensation leads to increased morale and improved productivity.

- Scalability: As businesses expand, their payroll systems must adapt seamlessly to evolving needs without sacrificing simplicity or compliance.

Conclusion: Empowering Growth with Zoho Payroll USA

Zoho Payroll USA's Professional plan represents a powerful solution for businesses navigating the complexities of growth. By simplifying multi-state payroll compliance, offering flexibility in compensation, and enhancing organizational efficiency, Zoho Payroll empowers businesses to scale with confidence. Whether it's managing state income taxes, understanding employment laws, or navigating tax withholding, Zoho Payroll is designed to support your business every step of the way.

Ready to Transform Your Payroll Operations?

If you're looking to simplify your payroll management and ensure compliance while growing your business, consider leveraging the capabilities of Zoho Payroll USA. Schedule a consultation with our experts at Creator Scripts to explore how Zoho Payroll can optimize your payroll processes and enhance operational efficiency. For more information about Zoho services and solutions, visit our Zoho Services page.

Together, let’s streamline your payroll and empower your business to thrive.

Frequently Asked Questions

What is the Zoho Payroll Professional Plan?

The Zoho Payroll Professional Plan is a comprehensive payroll management solution designed for businesses that require advanced features such as customized payroll processing, automated tax calculations, and detailed reporting. It streamlines the payroll process by accommodating specific business needs.

How does Zoho Payroll handle multi-state payroll compliance?

Zoho Payroll manages multi-state payroll compliance by automatically updating state-specific tax regulations and requirements. This ensures that businesses remain compliant with the differing laws of each state in which they operate, reducing the administrative burden on HR departments.

Can payroll processing be automated in the USA with Zoho Payroll?

Yes, Zoho Payroll offers automation for various payroll processes in the USA, such as calculating deductions, generating payslips, and distributing payments. This automation helps reduce errors, saves time, and improves overall efficiency.

What features does Zoho offer for payroll management software?

Zoho's payroll management software includes features such as direct deposit, automatic tax filing, employee self-service portals, leave management, compliance management, and customizable reports, all designed to simplify the payroll process for businesses.

How does Zoho Payroll ensure multi-state tax compliance?

Zoho Payroll ensures multi-state tax compliance by keeping its system updated with the latest tax laws and regulations of different states. It automatically calculates and withholds the correct state taxes for employees working in different locations, ensuring compliance and accuracy.